Core Platform Modernization

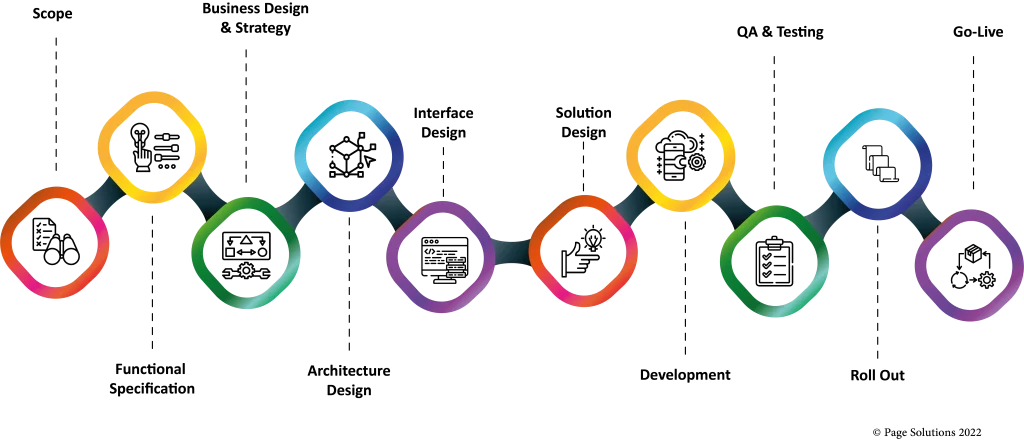

While each Core modernization effort is different, there are seven common levers that can facilitate the decomposition process, resulting in a much nimbler core. At Page Solutions, we work with our clients to define an agile, nimble and scalable core solution.

Key considerations for a Core Platform Modernization

Digital and virtual banking are table stakes for banks as customers expect fast, on-demand service, and employees expect digital capabilities to become ubiquitous. In parallel, there is a massive push for the availability of digital solutions, such as new digital apps, that require access to core banking data and functionality. Banks, therefore, need to accelerate their digitization agenda. For most, digitization has become a major challenge often leading to workarounds that cause massive replication of data. To digitize quickly and efficiently, banks need to modernize their core banking systems (CBS).

-

Core Banking

Temenos TRANSACT Suite -

Corporate Banking

Finestra Fusion Trade Innovation -

Treasury Management

Finestra Fusion - KTP

The Temenos Transact Core Banking platform is a proven, successful, and widely used digital core-banking solution in the world. Using cloud-native and agnostic technology, Temenos Transact provides the most extensive and richest set of banking functionality across retail, corporate, treasury, wealth, and payments with over 1000 banks in 150+ countries relying on it to provide market-leading and innovative products and services to their customers.

At Page Solutions, we have been in the Core Banking business cantered around the Temenos Core Banking Platform for the last 15 years. This is definitely our most experienced Skill Squad, comprising of Business SMEs and Technical Architects spanning Retail Banking, Corporate Banking, and banking operations.

Page Solutions Core Platform Modernization services built around the TEMENOS Transact Core Banking Platform, support Banks and Financial institutions to transform their legacy application landscape into a scalable, secure, and robust banking service delivery engine. We have continuously upgraded our capabilities in line with Temenos’s Product evolution and carry strengths in TAFj, Integration Framework (TAFj), the Extensibility framework, and JAVA-based customization.

Finastra’s Fusion Trade Innovation platform provides an end-to-end Working Capital solution that offers the industry’s leading capabilities for frictionless trade and supply chain finance including; buyer and seller loans, letters of credit, collections, guarantees, supply chain finance, and government support for export credit and SME loans.

At Page Solutions, our expertise in Trade Finance, Supply Chain Financing, and Corporate Loans runs deep in our business capabilities DNA. Our senior SMEs bring with them decades of cumulative experience in the Corporate Banking business and this coupled with our technical strengths of having implemented Trade Finance across enterprise applications around the world makes us a niche and competent player in this segment.

Page Solutions Core Platform Modernization services built around the Finestra Fusion TI platform, coupled with Loan Iq provide a complementing enterprise solution to Corporate banking clients.

Fusion KTP provides a proactive approach to treasury management, it offers an integrated, modular platform that ensures centralization across international businesses. Fusion KTP presents a consolidated view of liquidity and financial positions. And with detailed reporting and greater consistency across geographies, it addresses the critical aspects of your treasury operations and their traceability. The solution offers end-to-end multi‑asset coverage and supports collaborative cash and workflow management across your organization.

At Page Solutions, our business experience in Treasury extends across Front, Mid, and Bank office operations. This places us in a position of strength to review, optimize and advise on products, operations, and technology solutions. Our panel of experts brings in a significant collective experience gained from across the globe that covers Asian, European, and Middle East markets. Pair this with our technical strengths of having implemented Treasury solutions across enterprise applications around the world makes us a niche and competent player in this segment.

Page Solutions Core Platform Modernization services built around the Finestra – KTP platform, provide value-based services to our Capital Market clients.

Our Service Delivery | Skill Squads

We support Clients to transform their legacy banking applications into a scalable, secure, and robust banking service delivery engine. We support our clients to assess their platform applications and carve out modernization initiatives to deliver a Future-Ready operating environment.

Our Core Platform Modernization services are delivered through dedicated Skill Squads. These squads are specialized in specific services. The Squads also come together to provide cross-functional service delivery, based on program drivers

Our Flexible Engagement Models